Everything You Required to Know Concerning Offshore Company Development

Navigating the intricacies of offshore business development can be a difficult job for numerous people and services looking to increase their operations internationally. By unraveling the layers of benefits, challenges, steps, tax obligation effects, and compliance commitments connected with overseas company formation, one can obtain an extensive understanding right into this complex topic.

Advantages of Offshore Firm Formation

The advantages of establishing an offshore firm are multifaceted and can substantially profit organizations and people looking for critical economic preparation. One vital advantage is the capacity for tax obligation optimization. Offshore business are commonly based on favorable tax policies, enabling minimized tax obligations and enhanced revenues. Furthermore, establishing an offshore company can supply property security by separating personal properties from organization liabilities. This splitting up can guard individual riches in case of lawful disagreements or economic difficulties within business.

Additionally, offshore companies can promote worldwide company operations by supplying access to worldwide markets, branching out income streams, and enhancing organization integrity on a worldwide range. By establishing an overseas presence, organizations can touch into new opportunities for development and expansion past their domestic boundaries.

Typical Difficulties Dealt With

Despite the numerous advantages related to overseas business formation, individuals and businesses often run into usual obstacles that can influence their procedures and decision-making processes. Among the key difficulties encountered is the intricacy of international policies and compliance needs. Browsing differing legal structures, tax obligation laws, and reporting criteria across various jurisdictions can be lengthy and overwhelming. Making certain full conformity is vital to avoid legal issues and punitive damages.

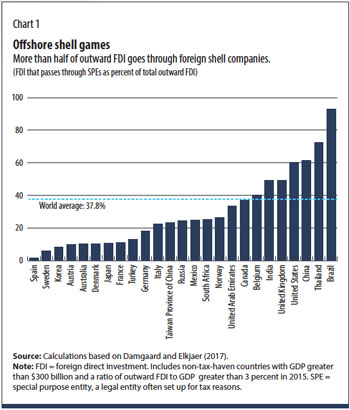

Another common difficulty is the threat of reputational damage. Offshore companies are often checked out with suspicion because of problems about tax evasion, money laundering, and absence of transparency. Managing and minimizing these perceptions can be difficult, especially in an increasingly inspected worldwide organization setting.

Additionally, developing and keeping reliable communication and oversight with offshore operations can be challenging as a result of geographical ranges, social distinctions, and time area differences. This can lead to misconceptions, hold-ups in decision-making, and troubles in monitoring the performance of offshore entities. Getting over these obstacles calls for careful planning, attentive risk management, and an extensive understanding of the regulative landscape in offshore jurisdictions.

Steps to Type an Offshore Company

Developing an overseas company entails a series of legitimately compliant and critical steps to make sure a successful and smooth formation procedure. The initial step is to select the overseas territory that ideal suits your business requirements. It is essential to comply with continuous coverage and conformity demands to keep the good standing of the offshore company.

Tax Ramifications and Factors To Consider

Strategically navigating tax implications is vital when creating an overseas firm. One of the main reasons individuals or services decide for overseas firm development is to take advantage of tax advantages. It is vital to comply and understand with both the tax obligation legislations of the offshore territory and those of the home nation to make sure legal tax obligation optimization.

Offshore firms are commonly subject to beneficial tax routines, such as reduced or absolutely no company tax obligation rates, exceptions on certain types of income, or tax obligation deferral choices. While these benefits can cause significant savings, it is essential to structure the overseas business in such a way that straightens with tax regulations to prevent potential lawful problems.

Additionally, it is crucial to consider the implications of Controlled Foreign Corporation (CFC) regulations, Transfer Prices regulations, and various other worldwide tax obligation legislations that may affect the tax therapy of an offshore firm. Seeking suggestions from tax experts or specialists with experience in offshore taxes can assist browse these complexities and ensure compliance with pertinent tax laws.

Managing Conformity and Regulations

Navigating via the intricate internet of conformity requirements and guidelines is essential for making sure the smooth operation of an offshore firm, particularly due to tax obligation implications and considerations. Offshore territories official site usually have particular regulations controling the formation and operation of business to stop cash laundering, tax evasion, and other illegal activities. It is crucial for firms to stay abreast of these policies to prevent large penalties, legal concerns, or even the possibility of being shut down.

To manage compliance efficiently, offshore firms need to appoint well-informed experts that understand the worldwide requirements and regional legislations. These professionals can assist in developing appropriate governance structures, maintaining accurate economic documents, and sending called for records to governing authorities. Normal audits and testimonials must be carried out to guarantee continuous compliance with all relevant regulations and laws.

In addition, staying notified about changes in regulation and adapting approaches click here for more info as necessary is vital for long-term success. Failing to follow guidelines can tarnish the reputation of the company and lead to severe effects, highlighting the value of prioritizing conformity within the overseas business's functional structure.

Final Thought

In verdict, overseas firm development uses different benefits, however likewise includes difficulties such as tax implications and compliance demands - offshore company formation. By complying with the needed steps and thinking about all aspects of forming an overseas business, services can make the most of worldwide possibilities while taking care of risks efficiently. It is necessary to remain educated regarding policies and continue to be certified to make sure the success and durability of the offshore organization venture

By unraveling the layers of advantages, difficulties, actions, tax effects, and compliance commitments connected with overseas company development, one can acquire a thorough understanding right into this multifaceted subject.

Offshore firms are typically subject to favorable tax laws, allowing for lowered tax obligations and increased revenues. One of the main reasons people or companies decide for offshore business development is to profit from tax benefits. Offshore territories typically have details legislations governing the formation and procedure of firms to avoid money laundering, tax evasion, and other immoral activities.In conclusion, offshore business development supplies various benefits, Learn More however additionally comes with challenges such as tax effects and compliance demands.

Comments on “Offshore Company Formation Demystified: Your Roadmap to Success”